Home » UK Business News • World Business & Employment News » UBS agrees ’emergency rescue’ of Credit Suisse

UBS agrees ’emergency rescue’ of Credit Suisse

https://www.whatjobs.com/news/united-kingdom/uk-business-news/ubs-agrees-emergency-rescue-of-credit-suisse

By Nagasunder in UK Business News, posted March 20, 2023

Rival Swiss bank UBS has stepped in to save the struggling Credit Suisse.

The decision was made on Sunday evening following a weekend of urgent discussions between the two banks and the Swiss financial regulators.

The arrangement, according to the Swiss National Bank, was the most effective approach to find a way of controlling economic risks and to regain market trust.

Read More: Credit Suisse accepts $54 billion lifeline

The Bank of England said it welcomed the "comprehensive set of actions".

Shareholders of Credit Suisse were not allowed to vote on the transaction, and they will get one share of UBS for every 22.48 shares they already possess, valuing the bank at $3.15 billion (£2.6 billion).

By Friday's business closing, Credit Suisse was worth approximately $8 billion (£6.5 billion).

Read More: Credit Suisse plans massive job cuts affecting 9,000 employees

Regulators were able to get a result before the start of the financial markets on Monday thanks to the agreement.

Switzerland's central bank said "a solution has been found to secure financial stability and protect the Swiss economy in this exceptional situation".

The federal government announced that it will provide UBS with a $9.6 billion (£7.9 billion) guarantee against any losses in order to lower any risks.

Read More: Credit Suisse to Pay Nearly $475 Million to U.S. and U.K. Authorities

Up to $110 billion (£90 billion) in liquidity support has also been provided by the Swiss central bank.

International financial institutions praised the agreement.

The Bank of England said it welcomed the "comprehensive set of actions" set out by the Swiss authorities.

"We have been engaging closely with international counterparts throughout the preparations for today's announcements and will continue to support their implementation."

Read More: Citigroup raises pay for most of its junior bankers at a time of mass layoffs

It said the UK banking system was "well capitalised and funded, and remains safe and sound".

The UK Treasury also said it hailed the merger and the British government would continue to involve with the Financial Conduct Authority (FCA) and the Bank of England "as is usual".

The FCA said on Sunday it was "minded to approve" the takeover to support financial stability as both UBS and Credit Suisse have operations in London.

"The FCA continues to engage closely with UK and international regulatory partners to monitor market developments," the watchdog said.

Read More: German bank Berenberg cuts 55 jobs from its London office

Christine Lagarde, President of the European Central Bank, also praised the "swift action" of the Swiss authorities.

"They are instrumental in restoring orderly market conditions and ensuring financial stability.

Ms. Lagarde said: "The euro area banking sector is resilient, with strong capital and liquidity positions,".

The US reiterated the president of the European Central Bank's remarks.

Both Federal Reserve Board chairman Jerome Powell and Treasury Secretary Janet Yellen stated that the Swiss government's action supported "financial stability".

"The capital and liquidity positions of the US banking system are strong, and the US financial system is resilient", they said.

Need Career Advice? Get employment skills advice at all levels of your career

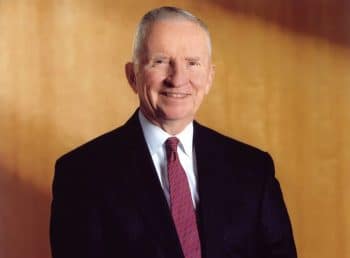

Following the news on Sunday night, UBS chairman Colm Kelleher stated that Credit Suisse was a "really excellent asset we are keen to maintain."

He said: "This acquisition is attractive for UBS shareholders but, let us be clear, as far as Credit Suisse is concerned, this is an emergency rescue,"

According to Mr. Kelleher, UBS would eliminate Credit Suisse's investment banking division.

The UBS chairman said it was "too early" to say what would happen about jobs: "We need to do this in a rational way thoughtfully, when we've sat down and analysed what we need to do,”.

The weekend agreement comes after the Swiss National Bank's emergency $54 billion (£44.5 billion) rescue on Wednesday failed to calm the markets, as Credit Suisse shares fell 24 percent, sparking a larger sell-off on European markets.

The 167-year-old bank is losing money and has recently dealt with a number of issues, including accusations of money laundering.

Source: BBC

Follow us on YouTube, Twitter, LinkedIn, and Facebook