With U.S. AI stocks trading at stretched valuations, global funds are betting that emerging market tech giants—from Taiwan to China—could offer a cheaper way to ride the artificial intelligence boom.

AI Fever Spreads Beyond Silicon Valley

Artificial intelligence may have its epicenter in the United States, but investors are increasingly looking east. Emerging market funds are piling into technology stocks tied to AI on expectations that the sector will drive global returns for the next decade.

The strategy is already paying off. According to Bloomberg data, six companies have been the biggest contributors to gains in the AM (Emerging Market) Stocks Index this year—almost all of them tied to the AI trade.

But with U.S. leaders like Nvidia and Microsoft trading at lofty multiples, investors are searching for value elsewhere.

Why Emerging Markets Offer a Hedge

Speaking on Bloomberg TV, Srini Sivalbull, senior emerging markets editor, noted that emerging markets provide a unique hedged play on the global AI race.

“U.S. AI is a bet on America winning the global race,” he said. “But in emerging markets, if the U.S. dominates, you still have winners like Taiwan Semiconductor Manufacturing Co. (TSMC). If China makes strides, then companies like Alibaba, Tencent, and Baidu benefit. Either way, emerging markets have a chance at winning.”

This dual exposure—where investors don’t have to pick just one global leader—makes EM funds attractive for those who want diversified AI exposure.

The Valuation Argument

Beyond diversification, there’s a more immediate draw: valuations.

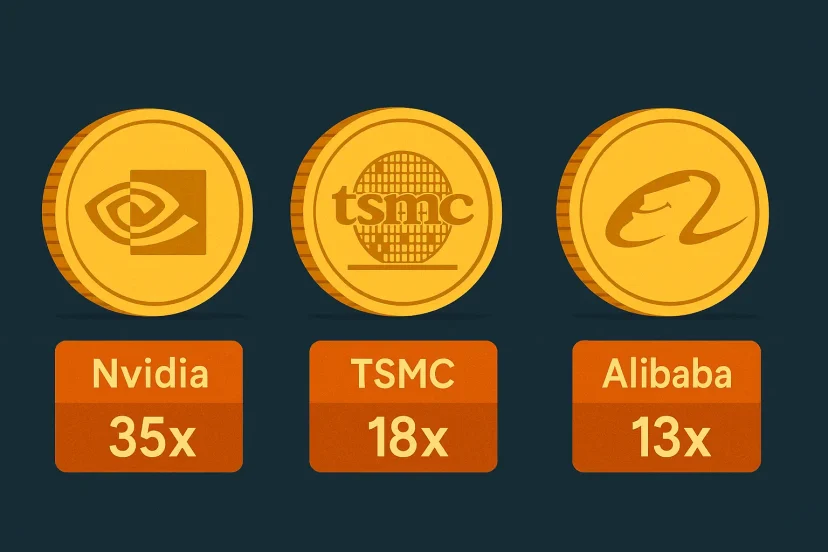

- Nvidia currently trades at about 35 times forward earnings.

- In comparison, TSMC trades at just 18 times, while Alibaba changes hands at 13 times.

For institutional investors wary of chasing already-stretched U.S. multiples, these figures make EM stocks look compelling.

“Emerging markets are offering a similar exposure at half the price—or less,” Sivalbull explained.

Can the Rally Last?

Of course, the biggest question for investors is sustainability. The current AI trade is heavily concentrated in a small set of major names across Taiwan, Korea, and China.

That narrowness raises the question: is this a bubble, or the beginning of a multi-decade cycle?

Sivalbull believes it’s the latter:

“AI is a megatrend that’s spreading around the world. It can go beyond temporary fluctuations in risk sentiment. Even though investor perceptions of emerging markets have ebbed and flowed in the past two years, the underlying adoption has made steady progress. This is a generational opportunity.”

Risks Investors Should Watch

Despite the optimism, EM investors must navigate risks:

- Geopolitical tensions: Taiwan’s central role in semiconductor manufacturing ties AI bets to sensitive U.S.-China relations.

- Regulatory uncertainty: Beijing’s crackdown on Chinese tech companies remains a risk for names like Alibaba and Tencent.

- Currency exposure: EM equities often come with FX volatility that can eat into dollar returns.

- Concentration risk: With a handful of firms driving most of the returns, portfolios may lack breadth.

Still, many fund managers argue that these risks are already reflected in lower valuations.

Hire Talent That Navigates Risk

Post your job on WhatJobs and connect with analysts, strategists, and risk managers who can help your business thrive amid geopolitical, regulatory, and market uncertainty.

Post a Job Now →A Generational Opportunity

The AI story is often told through Silicon Valley icons. But investors chasing the next decade of returns are broadening their horizons. Emerging markets offer cheaper valuations, diversification against geopolitical outcomes, and access to companies at the heart of global supply chains.

For now, the rally looks set to continue—and if the AI boom is truly a “megatrend,” EM funds may be among the biggest beneficiaries.

FAQs on Emerging Market AI Investing

1. Why are emerging markets attractive for AI exposure?

They provide a diversified hedge—investors gain if the U.S. leads AI innovation, but also benefit if China or other Asian markets make progress.

2. Which emerging market companies are key AI players?

Taiwan Semiconductor Manufacturing Co. (TSMC), Alibaba, Tencent, Baidu, and Korea’s SK Hynix are considered major beneficiaries of AI demand.

3. Are EM AI stocks cheaper than U.S. AI leaders?

Yes. Nvidia trades at ~35x forward earnings, while TSMC is ~18x and Alibaba ~13x, making valuations more attractive.

4. What are the main risks of investing in EM AI stocks?

Geopolitical risk, regulatory intervention, FX volatility, and concentration in a few large firms are the top concerns.