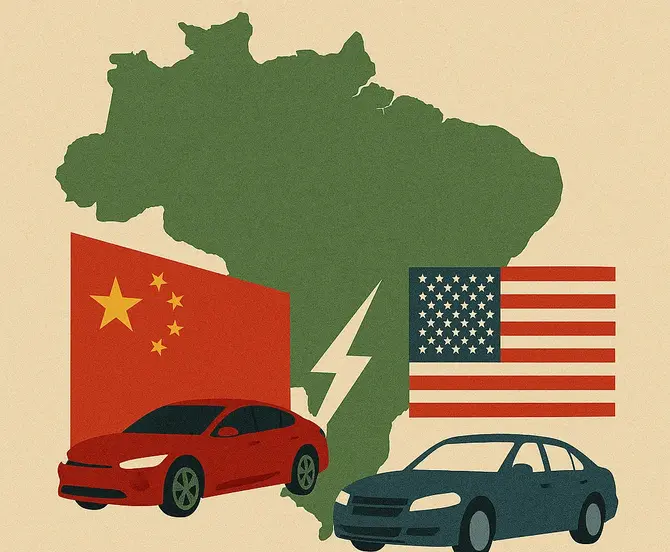

On the streets of Rio de Janeiro, electric vehicles from China dominate the landscape. BYD cars are everywhere. Brazilian consumers are buying Chinese EVs because the prices make sense, with everyone getting on board as manufacturers flood the market. Brazil, South America’s largest auto market, is becoming the next frontier in China’s electric vehicle expansion.

In 2024, Brazil imported around 138,000 EVs and hybrids from China—up nearly 100,000 from 2023. This surge mirrors a global trend where Chinese automakers, shut out of the US by tariffs, are turning to emerging markets like Southeast Asia, the Middle East, and Latin America to sell their massive vehicle oversupply.

Why Chinese Automakers Target Brazil

Chinese EV makers face intense pressure within China to find new customers and markets. As the world’s top auto exporter after surpassing the US, Japan, and Germany, China produced 31.2 million passenger cars, commercial vehicles, and trucks in 2024 compared with just 10.6 million made in the US. However, China’s economy is slowing while production continues unabated, creating excess supply that must be shipped somewhere.

Brazil ranks as the world’s sixth largest car market by volume and belongs to the BRICS coalition with China, making it particularly attractive. Its size, limited competition from other EV makers, and strong demand for Chinese EVs make Brazil an ideal target. In the first quarter of 2025, Chinese brands accounted for more than 80% of electric car sales in Brazil.

The Brazilian Tariff Window

Brazil created an opening for Chinese automakers that has since begun closing. Starting in 2015, the country lowered its 35% EV import tariff to zero, encouraging and signaling that this market welcomed Chinese automakers and others. However, tariffs were reintroduced in 2024 and will reach 35% in July 2026.

By removing tariffs, Brazil encouraged massive Chinese imports during a window when Beijing needed to export excess production. The massive shipments of Chinese vehicles to Brazil have expanded rapidly, with demand for charging infrastructure increasing accordingly. Even consumers wary of electric cars are drawn to Chinese EVs for their affordable price tags.

BYD sells its Dolphin Mini in Brazil for around $22,000 USD—over $7,000 less than General Motors‘ cheapest EV model sold in Brazil. This price advantage combined with China having closed the quality gap with established automakers means Brazilians will choose Chinese vehicles when price fits their budget, even if Chinese vehicles aren’t quite as nice as Toyota models.

US Automaker Retreat from Brazil

Brazil has long been a key South American outpost for US automakers. Companies like Ford and General Motors have been building cars in the country for over a century. However, recent years brought severe challenges. South America represents a difficult market where economies whipsaw unpredictably, struggling to sustain growth. This creates an environment of one good year followed by really tough years, making consistent profitability nearly impossible.

Ford shut down its Brazilian factory in 2021, citing financial pressure. In 2019 alone, the company lost over $700 million in South America operations. US automakers have felt profitability pressure, forcing them to protect their home market share and North American profitability—the real profit drivers. As they focused more on protecting profits at home, they questioned whether defending market share in Chile, Argentina, or Brazil was necessary.

General Motors announced in 2024 that it would invest $1.4 billion in Brazilian facilities and operations, suggesting some renewed commitment. However, US automakers remain concerned that the rapid growth of Chinese brands in Brazil mirrors a global trend where smaller markets add up to significant market share loss.

How BYD Conquered Brazil

BYD has been the most proactive Chinese company in Brazil’s market. The company arrived in 2015 manufacturing electric buses, then purchased Ford’s closed factory in 2023 with plans to produce EVs. The plant covers 4.6 million square meters—about 645 soccer fields—making it one of the biggest EV factories in Latin America. BYD says it will eventually produce 300,000 cars annually there.

BYD brought in $109 billion in revenue last year, representing 29% year-over-year growth. The company’s strategy mirrors what worked in China: be the first company selling EVs in new markets, create the market, then dominate it through scale and price advantages.

Great Wall Motor has followed a similar trajectory in Brazil. In 2021, the company purchased a shuttered Mercedes factory that closed due to pandemic-induced sales drops. In the first half of 2025, Great Wall sold almost 16,000 vehicles in Brazil, almost 20% more than the same period last year.

At least four Chinese auto brands now sell or manufacture in Brazil, including Great Wall Motor, Chery, Zeekr, and GAC. Combined, they’re rapidly reshaping Brazil’s automotive landscape.

The Labor Controversy

BYD has faced significant scrutiny from the public and regulators after workers at its newest factory were found in what investigators called slavery-like conditions. During factory construction, BYD brought in Chinese workers, which created major controversy when Brazilian police discovered they were being treated unfairly and didn’t meet labor standards.

BYD responded with a statement claiming zero tolerance for violations of human rights and labor laws, terminating its contract with the construction company. However, a lawsuit from Brazilian prosecutors against BYD remains ongoing. The episode illustrates concerns about Chinese investment’s impact on working conditions and labor standards.

The Labor Controversy

BYD’s rapid expansion in Brazil has drawn global scrutiny after reports of slavery-like conditions among imported workers. Though BYD claims zero tolerance for labor violations and ended ties with the contractor, a lawsuit from Brazilian prosecutors continues. The case underscores growing concerns about the ethical dimensions of global manufacturing and Chinese foreign investment.

Explore ESG & Corporate Ethics Roles →The Job Loss Worry

Brazilian officials and workers worry about employment impacts. The influx of Chinese cars, critics argue, threatens Brazilian jobs and domestic production. One Brazilian worker expressed grave concern: “This is a worrying scenario for us Brazilian workers because it could lead to a huge number of vehicles arriving from China, threatening our jobs and production in Brazil.”

There’s a huge volume of production, and in this case overproduction that China needs to export. Production costs are very competitive, beyond what Brazil or any other country with a similar footprint can compete with. The massive scale advantages and government subsidies supporting Chinese production create pricing power that undermines domestic manufacturing.

The Long-Term Strategy

This may be a strategy that doesn’t pay off short-term, but it’s much more about market creation and market acquisition rather than profitability. It represents very long-term thinking about global dominance in the EV space. The jury’s out on what’s going to work, but it’s certain that markets on the ground in several emerging markets are changing fundamentally.

As other automakers have pulled back from challenging markets like Brazil, Chinese companies have seized opportunity. The strategy involves going to any market that will take them, with emerging markets showing particularly strong interest. In Brazil, Chinese dominance demonstrates how government subsidies, technical capability, and excess production capacity combine to create an unstoppable export machine.

Why This Matters for Washington

Chinese expansion in automotive markets matters for Washington because there may not be full recognition of the implications. Smaller markets individually don’t constitute big deals, but adding Chile with Argentina, with Australia, with Israel, with South Africa creates substantial cumulative market share. That’s exactly what China has accomplished—little by little, all that market share grows.

For now, Brazil remains in the crossfire between two global superpowers during an EV revolution. One side aggressively exports excess capacity with government backing. The other has retreated to focus on protecting domestic market share and North American profitability. The results speak for themselves on Rio’s streets.

Frequently Asked Questions

Q: Why are Chinese EVs dominating Brazil’s market?

A: Chinese EVs accounted for 80% of sales in Q1 2025, with Brazil importing 138,000 vehicles in 2024. BYD sells models for $7,000 less than GM’s cheapest EV, combined with quality improvements and Brazil’s temporary zero-tariff window.

Q: What happened to US automakers in Brazil?

A: Ford shut down its Brazilian factory in 2021 after losing $700+ million in South America. US automakers retreated to protect North American profitability, while GM announced $1.4 billion investment in 2024 but remains a minor player.

Q: How did BYD establish itself in Brazil?

A: BYD arrived in 2015 making electric buses, then purchased Ford’s closed factory in 2023. The plant covers 4.6 million square meters and will produce 300,000 cars annually—one of Latin America’s biggest EV factories.

Q: What are the labor concerns with Chinese factories?

A: BYD faced allegations of slavery-like conditions at its factory construction site with Chinese workers. Brazilian prosecutors filed an ongoing lawsuit. BYD claims zero tolerance but the episode illustrates labor standard concerns.

Q: Why isn’t Brazil blocking Chinese imports?

A: Brazil lowered EV import tariffs to zero in 2015, creating a temporary window. Tariffs were reintroduced in 2024 and will reach 35% by July 2026. Critics say Chinese automakers flooded the market during the tariff-free period.

Q: How does this affect Brazilian workers?

A: Brazilian workers worry about job losses as Chinese imports compete with domestic production through heavily subsidized pricing. The massive scale and government support give China competitive advantages beyond Brazil’s ability to match.