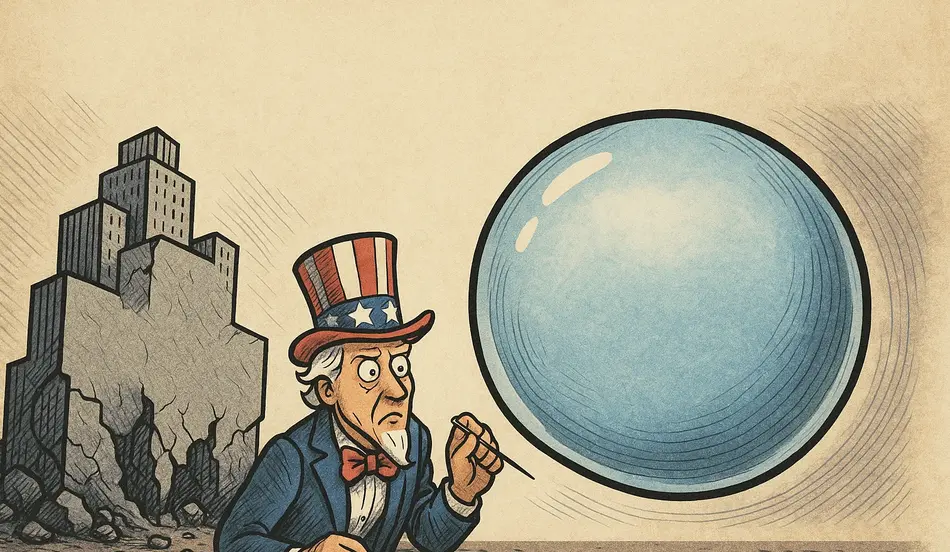

Everyone seems to think that AI is a bubble at the moment. Alongside the usual chorus of doomsayers, CEOs like Sam Altman, Jeff Bezos, and Mark Zuckerberg have all admitted to varying degrees that AI is looking a bit bubbly despite the fact that they have an incentive not to. Even hallowed institutions like the IMF and Bank of England, who usually stay out of this sort of thing, are now sounding the alarm.

The Investment-Revenue Mismatch: A Dangerous 8:1 Ratio

There are two big reasons that people think AI looks like a bubble. The first is the massive mismatch between the money that companies are investing in AI versus the money that AI is actually making. In 2025, companies in the US are expected to spend roughly $400 billion on data centers for AI alone and hundreds of billions more in the coming years.

Analysts at Morgan Stanley reckon that $2.9 trillion will be spent on data centers and related infrastructure by the end of 2028, while McKinsey puts it at an eye-watering $6.7 trillion by 2030. Of course, big numbers aren’t bad in and of themselves, but the problem is that all of this money is being invested into a technology that doesn’t yet generate much revenue.

The Economist estimates that AI-related revenues will total $50 billion in 2025. That means this year, the amount being invested in AI is seven or eight times the amount that the technology actually generates. To compare to previous bubbles, the investment-revenue ratio for telecom companies during the fiber optic bubble was about 4x and about 2x for rail companies during the railway bubble in the 19th century.

The Dodgy Financing: Circular Money Flows

The second reason people think AI looks bubbly is dodgy financing. The case that’s drawn most attention was a deal in late September between Nvidia and OpenAI whereby Nvidia agreed to invest up to $100 billion in OpenAI to fund more data centers, and OpenAI pledged to purchase millions of NVIDIA chips for those same data centers.

This looks suspiciously circular, as if Nvidia and OpenAI are just passing money between themselves to inflate their revenues. But this is far from the only case. Nvidia actually has similarly incestuous relationships with most big AI companies, creating a web of circular financing that inflates valuations without creating real economic value.

The Valuation Madness: $10 Billion for Nothing

Some of the valuations are mind-blowing. Mirror Morati’s new AI company, for instance, just raised the largest seed round in history at a $10 billion valuation, despite the fact the company hasn’t released a product and refused to tell investors what they’re even trying to build. This level of valuation without any product or clear business model is a classic sign of a bubble.

Even well-established tech companies, which previously funded their investments with cash on hand, have resorted to borrowing enormous sums of money and using accounting tricks to depress their reported spending. Companies like Meta and Microsoft are tapping private finance companies and using weird things like special-purpose vehicles, which essentially allow companies to borrow without having to actually show it on their books in order to fund their data center buildouts.

Behind Every Billion-Dollar Valuation Is a Talent War

The AI gold rush isn’t just about funding—it’s about who can hire the right people first. Top AI engineers, data scientists, and infrastructure specialists are commanding record offers. If you’re building in this space, speed and precision in hiring will determine your survival.

Hire Elite AI & Engineering Talent →The Systemic Risk: AI Keeping the Economy Afloat

This is obviously a risk for anyone in the industry or anyone with money in AI stocks. But perhaps most worryingly, it also looks like a systemic risk to the entire US economy. This is because AI is apparently keeping two of the four components of US GDP—investment and consumption—in the green.

Most of the recent growth in investment has come directly from AI-related spending, which alone now accounts for something like 40% of all US GDP growth. Moreover, there’s good reason to think that the AI boom is keeping consumption afloat too. This is because the AI boom has caused a stock market boom, with AI or AI-adjacent companies accounting for 80% of the S&P 500 gains this year.

The Rich Consumer Problem: 50% of All Spending

The stock market boom has encouraged rich Americans who are more likely to own stocks to continue spending their money, which has in turn kept consumption in the green. For context, the US economy is more reliant than ever on rich consumers, and the top 10% of earners now account for an unprecedented 50% of all spending.

This explains why consumer confidence is down to 2008 levels, but consumption keeps coming in above expectations. Your average American is paring back their spending, but rich Americans are splurging. If the AI bubble were to pop and stocks were to crash, this would cause rich Americans to pare back their spending too, pushing consumption into the red.

The Wealth Concentration Risk: 30% in Stocks

More generally, an unprecedented 30% of America’s net household wealth is currently tied up in stocks, making the overall economy more exposed than ever. Directly and indirectly, the health of the US economy is remarkably dependent on AI, which means that if AI is a bubble and that bubble pops, it would probably bring the US down with it.

Given the central role that the US plays in the global economy and the fact that foreigners have invested unprecedented amounts into American stocks, the rest of the world probably wouldn’t be much better off. The AI bubble has become a global systemic risk.

Behind Every Billion-Dollar Valuation Is a Talent War

The AI gold rush isn’t just about funding—it’s about who can hire the right people first. Top AI engineers, data scientists, and infrastructure specialists are commanding record offers. If you’re building in this space, speed and precision in hiring will determine your survival.

Hire Elite AI & Engineering Talent →The Safe Haven Problem: No Escape Route

There are also reasons to think that the US would be more affected than usual. In previous crises, the US has benefited from its status as the world’s safe haven, which has in turn allowed the US government to borrow massive amounts of money and spend its way out of a slump.

It’s not clear that the US could use the same strategy today, though, both because its status as a safe haven has been tarnished and because it lacks fiscal space. The traditional crisis response tools may not be available this time.

The Data Center Depreciation Problem

People like Jeff Bezos and Sam Altman have argued that even if AI is a bit of a bubble, it’s a good bubble. Because like the railways built in the railway bubbles or the fiber optic cables laid during the telecoms bubble, these data centers will eventually get used.

However, it’s worth noting that data centers are disanalogous in one key respect. Unlike railway and fiber optic cables, the chips in these data centers, which account for something like 60% of the overall cost, depreciate relatively quickly. This means that unless the industry recovers quickly from any crash, investors will be sitting on a pile of old chips that are being made redundant by new ones.

The Bottom Line: A Fragile Foundation

The US economy has become dangerously dependent on AI, with the technology accounting for 40% of GDP growth and 80% of stock market gains. The massive investment-revenue gap, circular financing, and concentration of wealth in AI-related stocks create a fragile foundation that could collapse if the AI bubble pops.

The traditional crisis response tools may not be available, and the rapid depreciation of AI hardware means that the infrastructure built during this bubble may become obsolete before it can generate returns. The US economy is more exposed to a single technology than at any point in its history.

FAQ Section

Q: Why is AI considered a bubble?

A: AI is considered a bubble because companies are investing $400 billion in AI data centers while generating only $50 billion in revenue, creating an 8:1 investment-to-revenue ratio that far exceeds historical bubbles.

Q: How does the AI bubble affect the US economy?

A: The AI bubble affects the US economy because AI accounts for 40% of GDP growth and 80% of stock market gains, making the entire economy dependent on AI’s success.

Q: What happens if the AI bubble pops?

A: If the AI bubble pops, it could cause a stock market crash, leading rich Americans to reduce spending and pushing consumption into the red, potentially bringing down the entire US economy.

Q: Why can’t the US use traditional crisis response tools?

A: The US may not be able to use traditional crisis response tools because its status as a safe haven has been tarnished and it lacks fiscal space to borrow and spend its way out of a slump.

The Path Forward: Preparing for the Inevitable

The AI bubble represents one of the greatest systemic risks to the US economy in modern history. The concentration of investment, wealth, and economic growth in a single technology creates a fragile foundation that could collapse at any moment. While some argue that this is a “good bubble” that will eventually pay off, the rapid depreciation of AI hardware and the unprecedented concentration of risk suggest otherwise.

The US economy has become a house of cards built on AI, and when that foundation crumbles, the entire structure may come down with it. The question isn’t whether the AI bubble will pop, but when, and whether the US economy can survive the fallout.