NVIDIA, the world’s most valuable chipmaker and the first U.S. company to reach a $4 trillion valuation, reported another record quarter even as questions swirl over its China sales and the long-term sustainability of the AI boom.

On Tuesday, the company announced fiscal second-quarter revenue of $46.7 billion, up 56% from the same quarter a year earlier. The figure topped Wall Street expectations but fell slightly short of consensus estimates on data center revenue, which came in at $41 billion compared with forecasts of $41.3 billion. Net income and earnings per share also exceeded analyst projections.

The company issued bullish guidance for the current quarter, projecting revenue of $54 billion, which would again set a record. Notably, that outlook assumes zero sales of its H20 chips to China, a market previously worth billions.

Demand Across Industries

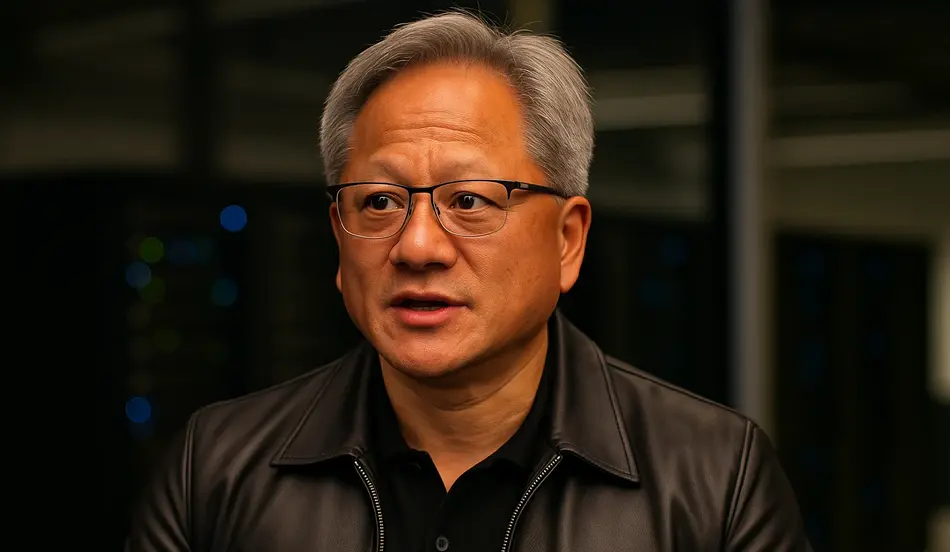

CEO Jensen Huang told Fox Business that the optimism stems from broad adoption of AI across industries.

“We are at the beginning of the AI revolution,” Huang said. “AI can now reason, basically think, do research, use tools, solve problems. That’s why ChatGPT has become so good. We are seeing AI in every industry—from enterprises and robotics to automation and self-driving cars.”

NVIDIA recently launched its second-generation Blackwell architecture, including the Blackwell Ultra GB300 supercomputer chips, which Huang said were already ramping toward $10 billion in committed orders.

Balancing U.S.–China Trade Tensions

One of the thorniest issues facing NVIDIA is its China business. Last year, the Biden administration restricted exports of advanced AI chips such as the H20 to Chinese firms. In July, President Donald Trump reversed the ban but required NVIDIA to remit 15% of its China revenues to the U.S. government as part of the deal.

Huang said NVIDIA has not yet received new H20 orders from China, but remains hopeful.

“The AI market in China is worth about $50 billion to us,” Huang said. “Several quarters ago, we were running at multi-billion per quarter. My hope is we will be able to go back and address a significant part of that.”

When pressed on whether NVIDIA would agree to further revenue-sharing demands from Washington, Huang was diplomatic.

“Ultimately, it is in the best interest of the country for us to be able to sell in China,” he said. “Whatever it takes to ensure that American tech stock becomes the global standard, like the U.S. dollar, is fine with us.”

Still, Huang acknowledged China’s domestic chipmakers are advancing rapidly:

“Local companies are very competitive. Manufacturing is their home-court advantage. Do not ever underestimate them.”

Supply Constraints and Surging Demand

NVIDIA has struggled to meet demand for its most advanced chips. Industry chatter suggests each Blackwell chip faces as many as ten competing orders, highlighting supply bottlenecks.

Huang emphasized that demand will remain strong for years as companies and governments build out “AI factories.”

“Over the next five years, I estimate three to four trillion dollars of AI infrastructure will be built,” Huang said. “We are at the very beginning of this buildout.”

Is There an AI Bubble?

Some industry leaders, including OpenAI CEO Sam Altman, have suggested the torrid pace of AI investment could form a bubble. Huang disagreed.

He pointed to explosive revenue growth at AI-native companies and model developers.

“Take all the AI-native companies—Perplexity, Cursor, Cohere, Google Gemini, Grok—they’re doing incredibly well,” Huang said. “AI revenues have grown from $2 billion last year to $20 billion this year, a tenfold increase in one year.”

Huang also noted that AI has only been generating commercial revenues for about two years, underscoring the relative youth of the market.

The Future: Robotics and Everyday AI

Looking ahead, Huang predicted that robotics will be one of the next great frontiers.

“Everything that moves will be robotic—every car, every tractor, every escalator,” he said. “We will see robotic surgery, robotic manipulators in factories, humanoid robots for general-purpose tasks. It’s a really exciting future.”

NVIDIA recently unveiled the Jetson Thor chip, designed to give robots immense compute power and enable them to operate with greater autonomy.

Hire the Builders of the Robotics Revolution

From AI engineers to robotics specialists, the future belongs to innovators who bring automation to life. Post your job on WhatJobs and connect with talent shaping tomorrow’s world.

Post a Job Now →Work and Society in the AI Era

Asked whether AI-driven productivity gains could shorten the workweek, Huang was cautious.

“I have to admit, I am afraid to say we are going to be busier in the future than now,” he said. “The more productive we are, the more opportunities there are to pursue new ideas. I expect GDP to grow and productivity to increase.”

Still, Huang acknowledged that social change will accompany each wave of industrial progress, much as previous revolutions shortened the workweek.

“Every job will be changed as a result of AI,” he added.

Investor and Market Reaction

NVIDIA stock initially fell more than 3% after the earnings release, hitting $176 before rebounding. By late afternoon, shares traded near $180, down 3.4% but close to flat on the session. Analysts remain divided on whether the company can maintain its momentum amid supply constraints and geopolitical headwinds.

Despite the volatility, Wall Street broadly sees NVIDIA as the central player in the AI hardware ecosystem, with its chips powering everything from cloud servers to emerging robotics platforms.

FAQs

1. Why did NVIDIA’s stock dip despite record earnings?

Although revenue and earnings beat estimates, data center revenue came in slightly below forecasts, and guidance assumes no China sales. Investors are also wary of supply bottlenecks and trade tensions.

2. What is NVIDIA’s strategy for China?

NVIDIA hopes to resume H20 and Blackwell chip sales to China under Trump’s licensing framework. Huang said the market could be worth $50 billion, but acknowledged local competitors are rapidly advancing.

3. Is there really an AI bubble forming?

Huang rejects the bubble narrative, citing rapid revenue growth at AI-native companies and continued global investment. He argues AI adoption is still in its early commercial phase.

4. How will AI and robotics affect jobs?

According to Huang, every job will be transformed by AI, though not necessarily eliminated. Productivity gains could raise GDP, but he predicts people will remain busy as new ideas and industries emerge.