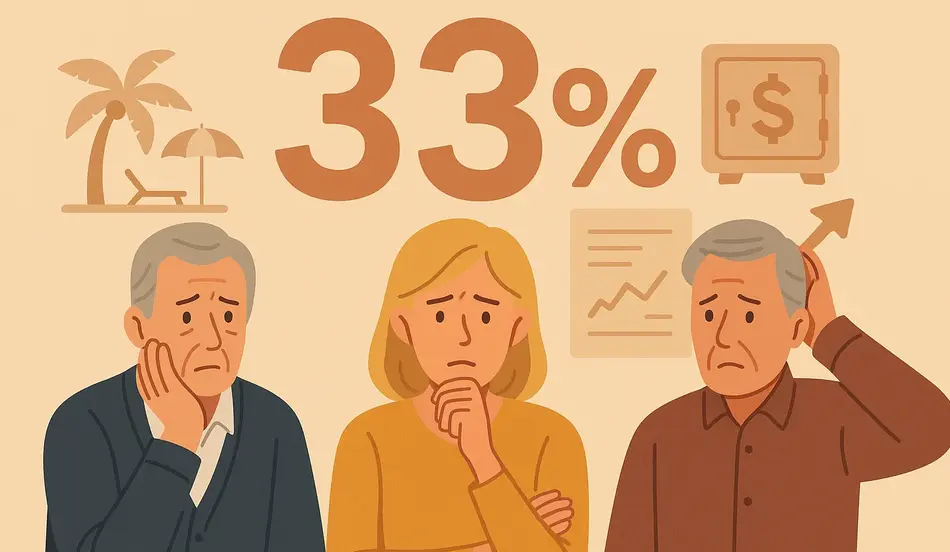

In a startling revelation that highlights the growing financial insecurity among American workers, a new Charles Schwab survey has exposed a critical gap in retirement preparedness. The survey reveals that Americans believe it takes more than $800,000 to be financially comfortable in retirement, yet approximately one-third of Americans have no financial plan whatsoever. This retirement planning crisis represents a significant threat to financial security and independence for millions of workers across the country.

The Retirement Planning Reality Check

The Charles Schwab survey paints a concerning picture of America’s financial preparedness. While workers and retirees express confidence in their retirement readiness—with 67% of workers and 78% of retirees believing they’ll have enough money to live comfortably—the reality tells a different story.

Retirement planning has become increasingly complex in today’s economic landscape, where traditional pension plans are disappearing, Social Security faces uncertainty, and the cost of living continues to rise. The disconnect between confidence and actual planning reveals a dangerous gap that could leave millions unprepared for their golden years.

Key Findings from the Charles Schwab Survey

The comprehensive study uncovered several critical insights about retirement planning attitudes and behaviors:

- $800,000+ needed for financial comfort in retirement

- 33% of Americans have no financial plan whatsoever

- 67% of workers are confident about retirement readiness

- 78% of retirees believe they’ll have enough money

- Significant gap between confidence and actual planning

Redefining Retirement: From Traditional Exit to Financial Independence

The conversation around retirement planning is evolving dramatically. According to CBS News business analyst Jill Schlesinger, the traditional notion of working until a certain date and then stopping completely is becoming outdated. Instead, people are seeking financial independence and control over their lives.

The New Retirement Paradigm

Schlesinger explains that modern workers aren’t necessarily interested in traditional retirement but rather in understanding “when I can have more control over my life.” This shift represents a fundamental change in how we approach retirement planning:

- Financial Independence Focus: Prioritizing control over complete work cessation

- Flexible Work Arrangements: Continuing to work on your own terms

- Lifestyle Design: Creating the life you want rather than following a rigid timeline

- Purpose-Driven Work: Finding meaning and satisfaction in continued employment

- Gradual Transitions: Using “off-ramps” to reduce work intensity over time

The Power of Modicum Control

Even small amounts of control can dramatically improve how people approach their financial lives. When individuals understand their retirement planning options and have a clear path forward, they’re more likely to make informed decisions about saving, investing, and career choices.

When to Start Retirement Planning: The Critical Timeline

The question of when to begin retirement planning has a simple answer: right now. Regardless of your age—whether you’re 20, 50, or 60—if you haven’t started planning, today is the day to begin.

Age-Based Retirement Planning Strategies

In Your 20s and 30s:

- Start with small contributions to employer-sponsored plans

- Take advantage of compound interest over time

- Build emergency funds and reduce debt

- Develop good financial habits early

In Your 40s and 50s:

- Maximize retirement account contributions

- Consider catch-up contributions if eligible

- Review and adjust your investment strategy

- Plan for healthcare costs in retirement

In Your 60s and Beyond:

- Optimize Social Security claiming strategies

- Consider part-time work or consulting

- Plan for required minimum distributions

- Review estate planning documents

The Foundation: Understanding Your Current Expenses

The most critical piece of retirement planning information is understanding how much money you spend right now. This includes:

- Basic living expenses: Housing, food, utilities, transportation

- Fun and discretionary spending: Entertainment, travel, hobbies

- Ongoing obligations: Supporting aging parents or adult children

- Healthcare costs: Insurance premiums, medications, medical care

- Debt payments: Credit cards, loans, mortgages

Without this baseline information, retirement planning becomes impossible. As Schlesinger emphasizes, “If you don’t know that piece of information, you cannot possibly do this.”

Retirement Accounts: Your Financial Foundation

Understanding and utilizing retirement accounts is essential for successful retirement planning. The key is to start early and automate your contributions.

401(k) and 403(b) Plans

These employer-sponsored retirement plans offer significant advantages:

- Tax-deferred growth: Contributions reduce current taxable income

- Employer matching: Free money from your company

- High contribution limits: Up to $23,500 annually (2024)

- Catch-up contributions: Additional $7,500 for those 50 and older

- Automatic enrollment: Many employers now default employees into plans

Individual Retirement Accounts (IRAs)

For those without employer plans or seeking additional savings:

- Traditional IRA: Tax-deductible contributions, taxable withdrawals

- Roth IRA: After-tax contributions, tax-free withdrawals

- Contribution limits: $7,000 annually ($8,000 for 50+)

- Flexible investment options: Choose from various asset classes

- No required minimum distributions: Roth IRAs offer more flexibility

The Automation Advantage

Research shows that people save more when contributions are automated. Even small amounts—starting with just a few percentage points of your salary—can grow significantly over time through compound interest.

Take Control of Your Financial Future

With 1 in 3 Americans lacking a retirement plan, the time to act is now. Secure a better job, increase your income, and start building toward financial independence today.

Explore Better-Paying Jobs →Social Security: The Retirement Planning Cornerstone

Social Security remains a critical component of retirement planning, despite concerns about its future sustainability.

Understanding Social Security Benefits

The Social Security Administration provides three key claiming ages:

- Age 62: Earliest claiming age, but results in a 25% permanent reduction

- Full Retirement Age: Generally 67 for those born after 1960

- Age 70: Maximum benefit with 8% annual increases for each year delayed

The Power of Delaying Benefits

Every year you wait to claim Social Security after your full retirement age provides an 8% increase in benefits. Additionally, Social Security benefits are indexed for inflation, making them particularly valuable for long-term retirement planning.

Planning with Social Security

To incorporate Social Security into your retirement planning:

- Visit ssa.gov to create your account

- Review your earnings record for accuracy

- Use the retirement calculator to estimate benefits

- Consider different claiming strategies with your spouse

- Factor in potential benefit reductions in future legislation

Running the Numbers: Customizing Your Retirement Plan

Instead of relying on arbitrary rules of thumb, successful retirement planning requires personalized calculations based on your unique circumstances.

Essential Retirement Planning Tools

Retirement Calculators:

- Free online calculators from major financial institutions

- Employer-provided planning tools

- Professional financial planning software

- Social Security Administration calculators

Key Inputs for Accurate Planning:

- Current annual expenses

- Expected retirement age

- Life expectancy estimates

- Investment return assumptions

- Inflation expectations

- Healthcare cost projections

What to Do When the Math Doesn’t Work

When retirement planning calculations show a shortfall, you have several options to improve your situation:

- Increase Savings: Boost contributions to retirement accounts

- Work Longer: Extend your career by a few years

- Reduce Expenses: Cut current spending to save more

- Optimize Investments: Review and adjust your asset allocation

- Consider Part-Time Work: Create an “off-ramp” strategy

The Off-Ramp Strategy

The pandemic highlighted the need for flexible retirement transitions. Many workers found themselves “fried” and unable to continue their current pace. The off-ramp strategy involves:

- Reduced Workload: Working fewer hours or less demanding roles

- Gradual Transition: Slowly reducing work intensity over time

- Income Flexibility: Accepting lower pay for better work-life balance

- Purpose-Driven Work: Finding meaningful employment that’s less stressful

The Retirement Planning Confidence Gap

The survey reveals a concerning disconnect between confidence and actual planning. While 67% of workers express confidence in their retirement readiness, 33% have no financial plan at all.

Understanding the Confidence Gap

This gap exists for several reasons:

- Optimism Bias: People tend to be overly optimistic about their future

- Lack of Information: Many don’t understand what retirement planning requires

- Procrastination: The tendency to delay important financial decisions

- Complexity Overwhelm: Retirement planning can seem too complicated

- Social Comparison: Comparing oneself to others who may also be unprepared

Bridging the Gap

To close the confidence gap and improve retirement planning outcomes:

- Education: Learn about retirement planning basics

- Professional Help: Consider working with a financial advisor

- Regular Reviews: Update your plan annually

- Realistic Expectations: Set achievable goals based on your circumstances

- Action Steps: Take concrete steps to improve your situation

The Longevity Factor: Planning for a Longer Life

Modern retirement planning must account for increasing life expectancy. If you’re over 40, you might live until 95. If you’re under 40, you could live to 100.

Longevity Planning Considerations

Healthcare Costs:

- Medicare premiums and out-of-pocket expenses

- Long-term care insurance or self-funding

- Prescription drug costs

- Dental and vision care

Income Needs:

- Higher savings requirements for longer retirements

- Social Security claiming strategies for maximum benefits

- Part-time work or consulting opportunities

- Reverse mortgages or home equity utilization

Lifestyle Planning:

- Maintaining physical and mental health

- Social connections and community involvement

- Purpose and meaning in retirement

- Housing and transportation needs

Conclusion: Taking Control of Your Retirement Future

The retirement planning crisis revealed by the Charles Schwab survey serves as a wake-up call for all Americans. While the numbers may seem daunting—$800,000+ needed for financial comfort—the solution lies in taking action today, regardless of your age or current financial situation.

The key to successful retirement planning is understanding that it’s not about reaching a specific age and stopping work entirely. Instead, it’s about achieving financial independence and control over your life. Whether that means working part-time, pursuing passion projects, or having the freedom to choose when and how you work, retirement planning is about creating the life you want.

Start today by understanding your current expenses, exploring retirement calculators, and taking advantage of employer-sponsored plans. Remember that even small steps—like automating your 401(k) contributions or opening an IRA—can make a significant difference over time.

As Jill Schlesinger emphasizes, the goal is to give yourself “a modicum of control” over your financial future. With proper retirement planning, you can approach your financial life with confidence and create the retirement you’ve always dreamed of.

FAQ Section

What is retirement planning and why is it important?

Retirement planning is the process of determining retirement income goals and the actions necessary to achieve those goals. It’s important because it helps ensure financial security in your later years, allows you to maintain your desired lifestyle, and provides peace of mind knowing you’re prepared for the future.

How much money do I need for retirement planning?

The amount needed for retirement varies based on individual circumstances. While the Charles Schwab survey shows Americans believe they need $800,000+, the actual amount depends on your current expenses, desired lifestyle, life expectancy, and other income sources like Social Security. Use retirement calculators to determine your specific needs.

When should I start retirement planning?

You should start retirement planning immediately, regardless of your age. The earlier you begin, the more time your money has to grow through compound interest. Even small contributions in your 20s can grow significantly over time, making early retirement planning crucial for long-term success.

What are the best retirement planning strategies?

The best retirement planning strategies include starting early, maximizing employer-sponsored plans like 401(k)s, understanding your current expenses, using retirement calculators, considering Social Security claiming strategies, and creating a personalized plan based on your unique circumstances and goals.