Introduction: The Emerging Quiet Recession Signs 2025

Quiet recession signs 2025 are becoming increasingly evident across the American economy, despite the Federal Reserve’s continued narrative about achieving a soft landing. These quiet recession signs 2025 represent a concerning disconnect between official economic messaging and the underlying reality that many economists and analysts are beginning to recognize. The quiet recession signs 2025 suggest that the United States may already be experiencing an economic downturn that has been masked by selective data interpretation and optimistic projections.

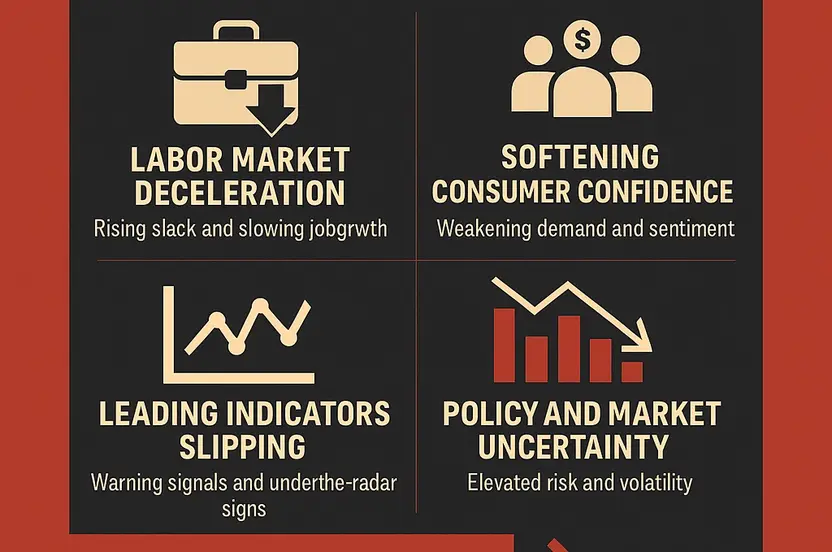

The quiet recession signs 2025 are particularly troubling because they indicate that the Federal Reserve’s aggressive monetary policy may have already pushed the economy into recession territory. These quiet recession signs 2025 include net job losses, declining consumer confidence, and increasing difficulty for American workers to secure employment. Understanding these quiet recession signs 2025 is crucial for policymakers, investors, and everyday Americans who need to prepare for potential economic challenges ahead.

The Job Market Reality: Core Quiet Recession Signs 2025

Net Job Losses: The Most Critical Quiet Recession Signs 2025

The most significant of the quiet recession signs 2025 is the emergence of net job losses in the American economy. Recent data revisions to quarterly payroll growth reveal that the second quarter of 2024 experienced net job losses, marking a critical turning point in the economic landscape. These quiet recession signs 2025 in the labor market are particularly concerning because they represent a fundamental shift from job creation to job destruction.

The quiet recession signs 2025 in employment data are especially troubling because layoffs are traditionally considered a lagging indicator of economic health. The fact that net job losses began more than a year ago suggests that the quiet recession signs 2025 have been building for some time, even as the Federal Reserve maintained its soft landing narrative. This disconnect between the quiet recession signs 2025 and official messaging has created confusion among market participants and policymakers.

The quiet recession signs 2025 in the job market are particularly significant because employment is one of the Federal Reserve’s dual mandate responsibilities. The emergence of these quiet recession signs 2025 creates a tension between the Fed’s inflation-fighting objectives and its employment mandate, a tension that Federal Reserve Chair Jerome Powell has explicitly acknowledged in recent communications.

The Jobs Hard to Get Indicator: Subtle Quiet Recession Signs 2025

Among the more subtle quiet recession signs 2025 is the increasing difficulty American workers face in securing employment. The Conference Board’s consumer confidence report reveals that while overall confidence may have rebounded in July, the “jobs hard to get” measure actually increased during the same period. These quiet recession signs 2025 indicate that despite any surface-level improvements in consumer sentiment, the underlying employment market is becoming more challenging for job seekers.

The quiet recession signs 2025 in the jobs market are particularly concerning because they suggest a mismatch between consumer confidence and economic reality. While households may be experiencing some relief from disinflation, the quiet recession signs 2025 in employment suggest that the economic foundation is weakening. This creates a complex situation where consumers feel better about inflation but worse about their employment prospects.

The quiet recession signs 2025 in the jobs market also highlight the Federal Reserve’s challenging position. As these quiet recession signs 2025 become more apparent, dovish members of the Federal Open Market Committee are likely to argue that the employment mandate should take precedence over inflation concerns. The quiet recession signs 2025 in employment data provide ammunition for those advocating for more accommodative monetary policy.

Hiring in Recession-Resistant Sectors? Post Jobs for Free

Find talent for roles that remain in demand—despite the quiet recession signals shaping the 2025 economy.

Post a Job Now →Consumer Confidence and Quiet Recession Signs 2025

The Disinflation Effect on Quiet Recession Signs 2025

The quiet recession signs 2025 are being partially masked by the positive effects of disinflation on consumer sentiment. Recent data from both the Conference Board and the University of Michigan shows that inflation expectations among households are falling rapidly. While this represents positive news for American households that have been struggling with rising costs of living, it also creates a complex backdrop for interpreting the quiet recession signs 2025.

The quiet recession signs 2025 are particularly difficult to read because disinflation is providing relief to consumers even as other economic indicators deteriorate. This creates a situation where the quiet recession signs 2025 may be overlooked or downplayed because of improving consumer sentiment. However, the underlying quiet recession signs 2025 in employment and economic activity suggest that this improvement in consumer confidence may be temporary or misleading.

The quiet recession signs 2025 are further complicated by the fact that consumer confidence can be influenced by multiple factors beyond just employment and inflation. The quiet recession signs 2025 in the broader economy may not immediately translate to consumer sentiment, creating a lag that can obscure the true economic picture.

The Tension Between Inflation and Employment: Quiet Recession Signs 2025

The quiet recession signs 2025 are creating a significant tension within the Federal Reserve’s dual mandate framework. Federal Reserve Chair Jerome Powell has explicitly acknowledged this tension, noting that the Fed must balance its inflation-fighting objectives with its employment mandate. The quiet recession signs 2025 in employment data are making this balancing act increasingly difficult.

The quiet recession signs 2025 are particularly challenging for the Federal Reserve because they suggest that the economy may have already entered recession territory. The quiet recession signs 2025 in job losses and employment difficulty indicate that the Fed’s aggressive monetary policy may have been too restrictive, pushing the economy beyond the soft landing scenario that policymakers had hoped to achieve.

The quiet recession signs 2025 are also creating divisions within the Federal Open Market Committee. Dovish members are likely to point to these quiet recession signs 2025 as evidence that the Fed should prioritize employment over inflation concerns. The quiet recession signs 2025 provide a strong argument for more accommodative monetary policy, even as inflation remains above the Fed’s 2% target.

The Federal Reserve’s Response to Quiet Recession Signs 2025

Data Revisions and Quiet Recession Signs 2025

The quiet recession signs 2025 are becoming more apparent as the Federal Reserve receives revised economic data. The upcoming release of revised quarterly payroll growth data is expected to confirm the quiet recession signs 2025 that have been emerging in recent months. These data revisions are crucial for understanding the true state of the economy and the quiet recession signs 2025 that may have been overlooked in initial reports.

The quiet recession signs 2025 revealed through data revisions are particularly concerning because they suggest that the economic situation may be worse than initially reported. The quiet recession signs 2025 in net job losses indicate that the economy may have entered recession territory earlier than many analysts had anticipated. This creates challenges for the Federal Reserve as it attempts to navigate the tension between its dual mandates.

The quiet recession signs 2025 revealed through data revisions also highlight the importance of looking beyond surface-level economic indicators. The quiet recession signs 2025 suggest that the economy may be experiencing a more complex and challenging situation than the soft landing narrative would indicate.

The Dovish Argument and Quiet Recession Signs 2025

The quiet recession signs 2025 are providing strong ammunition for dovish members of the Federal Open Market Committee. These policymakers are likely to argue that the quiet recession signs 2025 in employment data justify a more accommodative monetary policy stance. The quiet recession signs 2025 suggest that the Fed’s aggressive rate hikes may have been too restrictive and may have pushed the economy into recession territory.

The quiet recession signs 2025 are particularly compelling for dovish arguments because they represent concrete evidence of economic deterioration. The quiet recession signs 2025 in net job losses and employment difficulty provide clear indicators that the economy may need monetary stimulus rather than continued restraint.

The quiet recession signs 2025 are also creating pressure on the Federal Reserve to acknowledge the reality of the economic situation. As these quiet recession signs 2025 become more apparent, the Fed may need to adjust its messaging and policy approach to reflect the actual state of the economy rather than the soft landing narrative.

The Broader Economic Implications of Quiet Recession Signs 2025

Market Impact of Quiet Recession Signs 2025

The quiet recession signs 2025 are likely to have significant implications for financial markets as they become more widely recognized. The quiet recession signs 2025 suggest that investors may need to adjust their expectations for economic growth and corporate earnings. The quiet recession signs 2025 in employment data indicate that consumer spending may face headwinds, which could impact corporate profitability and market valuations.

The quiet recession signs 2025 are also likely to influence Federal Reserve policy decisions, which could have significant implications for interest rates and asset prices. The quiet recession signs 2025 provide justification for more accommodative monetary policy, which could support asset prices but may also raise concerns about inflation re-accelerating.

The quiet recession signs 2025 are creating uncertainty in financial markets as participants try to assess the true state of the economy. The quiet recession signs 2025 suggest that the economic situation may be more complex and challenging than the official narrative would indicate.

Policy Implications of Quiet Recession Signs 2025

The quiet recession signs 2025 are likely to influence policy decisions at multiple levels of government. The quiet recession signs 2025 in employment data suggest that fiscal policy may need to play a larger role in supporting the economy. The quiet recession signs 2025 indicate that monetary policy alone may not be sufficient to address the economic challenges facing the United States.

The quiet recession signs 2025 are also likely to influence the Federal Reserve’s communication strategy. As these quiet recession signs 2025 become more apparent, the Fed may need to adjust its messaging to reflect the actual economic situation rather than the soft landing narrative. The quiet recession signs 2025 suggest that the Fed may need to be more transparent about the challenges facing the economy.

The quiet recession signs 2025 are creating pressure for coordinated policy responses across different government agencies. The quiet recession signs 2025 indicate that the economic situation may require a more comprehensive approach than monetary policy alone can provide.

Frequently Asked Questions About Quiet Recession Signs 2025

What are the main quiet recession signs 2025 that economists are seeing?

Quiet recession signs 2025 include net job losses in recent quarters, increasing difficulty for workers to secure employment, and declining consumer confidence despite disinflation. These quiet recession signs 2025 suggest the economy may have already entered recession territory despite the Fed’s soft landing narrative.

How do quiet recession signs 2025 affect Federal Reserve policy decisions?

Quiet recession signs 2025 create tension within the Fed’s dual mandate, forcing policymakers to balance inflation concerns with employment objectives. These quiet recession signs 2025 provide ammunition for dovish committee members advocating for more accommodative monetary policy.

Why are quiet recession signs 2025 being overlooked by some analysts?

Quiet recession signs 2025 are being partially masked by positive disinflation effects on consumer sentiment and selective data interpretation. The quiet recession signs 2025 suggest a disconnect between surface-level economic indicators and underlying economic reality.

How should investors respond to quiet recession signs 2025?

Quiet recession signs 2025 suggest investors should prepare for potential economic headwinds and adjust expectations for growth and earnings. These quiet recession signs 2025 may also indicate opportunities in defensive sectors and assets that perform well during economic downturns.

Conclusion: Understanding the Quiet Recession Signs 2025

The quiet recession signs 2025 represent a critical challenge for policymakers, investors, and everyday Americans. These quiet recession signs 2025 suggest that the United States may already be experiencing an economic downturn that has been masked by optimistic narratives and selective data interpretation. The quiet recession signs 2025 in employment data, consumer confidence, and economic activity indicate that the Federal Reserve’s aggressive monetary policy may have pushed the economy beyond the soft landing scenario.

The quiet recession signs 2025 are particularly concerning because they create a complex policy environment for the Federal Reserve. The quiet recession signs 2025 highlight the tension between the Fed’s inflation-fighting objectives and its employment mandate, forcing policymakers to make difficult decisions about monetary policy direction. The quiet recession signs 2025 provide strong arguments for more accommodative policy while also raising concerns about inflation re-accelerating.

As the quiet recession signs 2025 become more apparent, it will be crucial for all economic participants to adjust their expectations and strategies accordingly. The quiet recession signs 2025 suggest that the economic situation may be more challenging and complex than the official narrative would indicate. Understanding and responding appropriately to these quiet recession signs 2025 will be essential for navigating the economic challenges ahead.

The quiet recession signs 2025 serve as a reminder that economic reality often differs from official messaging and that careful analysis of underlying data is essential for making informed decisions. The quiet recession signs 2025 highlight the importance of looking beyond surface-level indicators to understand the true state of the economy and prepare for potential challenges ahead.