Introduction: The $8.8 Million Banking Fraud That Started With a Simple Alert

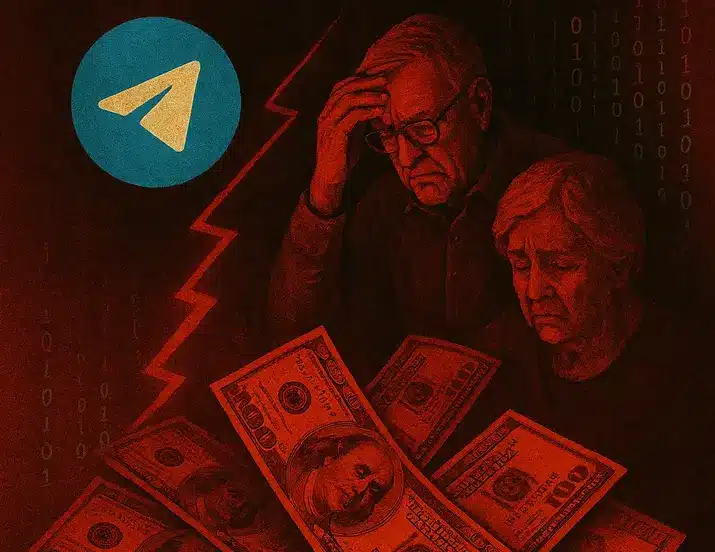

The discovery of a sophisticated Telegram fraud ring began with a simple banking alert that would ultimately reveal one of the most complex financial crime operations in recent history. When an online banking detective from Synchry noticed a new account suddenly receiving $250,000, little did anyone know this would lead to uncovering an $8.8 million fraud and theft ring that spanned multiple states and exploited hundreds of elderly victims.

This Telegram fraud ring represents a new era of cybercrime where traditional banking fraud meets modern encrypted messaging platforms, creating a perfect storm for criminals to operate with near impunity. The investigation revealed a complex network of bank employees, data thieves, and money launderers who used Telegram’s secret chat features to coordinate their illegal activities while targeting the most vulnerable members of society.

The Anatomy of the Telegram Fraud Ring

How the Banking Data Theft Began

The Telegram fraud ring originated with Antonio Pin, a five-year employee at M&T Bank, a banking group based in the Northeast United States. Despite his limited access to sensitive banking data, Pin devised a sophisticated scheme to bypass security measures by recruiting two long-term associates who had the necessary clearance levels.

Barbara Frzy and Camala Schaefer, both employees with over 35 years of experience at the bank, provided Pin with either direct access to banking data or the security codes needed to access customer information. This insider access proved crucial to the success of the Telegram fraud ring, as it allowed criminals to obtain detailed account information for thousands of unsuspecting victims.

The Role of Telegram in the Criminal Network

Once Pin obtained the stolen banking data, he would transmit it to his associate Oki Aushi, who served as the digital marketplace operator for the Telegram fraud ring. Aushi would then upload the stolen account information to Telegram channels, where criminals from around the world could purchase access to victim accounts.

The use of Telegram proved instrumental to the Telegram fraud ring‘s success due to the platform’s end-to-end encryption and secret chat features. These security measures allowed criminals to communicate and conduct business without fear of law enforcement interception.

The Criminal Network and Money Laundering Operation

The International Scope of the Fraud

The Telegram fraud ring attracted buyers from around the world who would purchase stolen account data and then create multiple fraudulent accounts to drain victim funds. Each participant in the network maintained numerous accounts, with some criminals operating up to 20 or 30 different accounts simultaneously to maximize their theft potential.

The investigation revealed that the Telegram fraud ring operated across multiple states, with key players located in Missouri, Maryland, West Virginia, and Florida. This geographic spread made the investigation particularly challenging for law enforcement, requiring coordination between multiple agencies and jurisdictions.

The Money Laundering Process

The Telegram fraud ring employed a sophisticated money laundering operation to conceal the origins of stolen funds. Once criminals purchased account data from Telegram channels, they would set up multiple accounts and transfer stolen money through various financial institutions to obscure the paper trail.

Rashoto Durant, Hassan Phillips, Michael Neverz, and Kevin Clayton emerged as key players in the money laundering aspect of the Telegram fraud ring. These individuals would purchase stolen data and then push money back upstream through the criminal network, creating a complex web of financial transactions designed to hide the true source of funds.

The Human Cost: Elderly Victims and “Dead Money” Accounts

Targeting the Most Vulnerable

One of the most disturbing aspects of the Telegram fraud ring was its deliberate targeting of elderly victims. Antonio Pin, who liked to be known as “Showtime Pin,” specifically targeted what he called “dead money accounts” – accounts belonging to elderly individuals who were less likely to monitor their banking activity regularly.

The Telegram fraud ring exploited the vulnerability of elderly victims who often had substantial savings but limited digital literacy to detect fraudulent activity. This targeting strategy proved highly profitable for the criminals while causing devastating financial and emotional harm to victims and their families.

The Impact on Victims and Families

The Telegram fraud ring caused more than just financial losses for its victims. Many elderly individuals lost their life savings, retirement funds, and the financial security they had worked decades to build. The psychological impact of discovering that their hard-earned money had been stolen through sophisticated cybercrime left many victims feeling violated and helpless.

Ready to Hire?

Reach thousands of motivated job seekers today. Post your job for free on WhatJobs and connect with qualified candidates who are ready to work.

Post a Job Now →The investigation revealed that the Telegram fraud ring had victimized hundreds of individuals across multiple states, with some victims losing hundreds of thousands of dollars. The scale of the fraud operation meant that many victims may never recover their stolen funds, even after the criminal network was dismantled.

Law Enforcement Response and Investigation

The Multi-Agency Investigation

The investigation into the Telegram fraud ring required unprecedented coordination between multiple law enforcement agencies. The Polk County Sheriff’s Office worked closely with the Statewide Prosecutor’s Office, the Florida Department of Law Enforcement (FDLE), and other agencies to piece together the complex criminal network.

The investigation involved serving 18 search warrants and obtaining subpoenas from several banks to trace the flow of stolen funds. The complexity of the Telegram fraud ring required investigators to follow digital trails across multiple jurisdictions and financial institutions, making it one of the most challenging cases in recent memory.

The Role of Banking Detectives

The initial detection of the Telegram fraud ring highlights the crucial role that banking detectives play in identifying and preventing financial fraud. The Synchry banking detective who first noticed the suspicious $250,000 deposit demonstrated the importance of vigilant monitoring systems in detecting sophisticated fraud operations.

This case serves as a model for how banking institutions and law enforcement can work together to identify and dismantle complex fraud networks. The early detection and rapid response were crucial to limiting the damage caused by the Telegram fraud ring.

The Legal Consequences and Criminal Charges

RICO Charges and Criminal Prosecution

The severity of the Telegram fraud ring operation led to the use of RICO (Racketeer Influenced and Corrupt Organizations) charges against the primary defendants. When Rashoto Durant was informed of the RICO charges, he reportedly responded, “Hey, I thought only rappers got charged with RICO,” demonstrating a lack of understanding about the serious nature of organized financial crime.

The use of RICO charges against the Telegram fraud ring participants reflects the sophisticated and organized nature of their criminal enterprise. These charges carry severe penalties and demonstrate law enforcement’s commitment to treating cybercrime with the same seriousness as traditional organized crime.

The Geographic Reach of Prosecution

The prosecution of the Telegram fraud ring spanned multiple states, from Missouri to Maryland to Florida. This multi-jurisdictional approach was necessary given the widespread nature of the criminal network and the need to ensure that all participants faced appropriate legal consequences.

The investigation revealed that hundreds of additional suspects remain at large, highlighting the ongoing challenge of combating cybercrime networks that operate across multiple jurisdictions and international borders.

The Role of Technology in Modern Cybercrime

Telegram’s Role in Criminal Enterprises

The Telegram fraud ring case highlights the growing role of encrypted messaging platforms in facilitating criminal activity. Telegram’s end-to-end encryption and secret chat features have made it an attractive platform for criminals seeking to communicate without law enforcement detection.

The platform’s CEO, Pavel Durov, was arrested in 2024 by French authorities for involvement in criminal enterprises online. This arrest led to increased cooperation from Telegram in criminal investigations, though the platform continues to be used by criminal networks worldwide.

The Evolution of Banking Fraud

The Telegram fraud ring represents a new evolution in banking fraud that combines traditional insider threats with modern digital marketplaces. The use of encrypted messaging platforms to facilitate the sale of stolen data has created new challenges for law enforcement and financial institutions.

This case demonstrates how criminals are increasingly leveraging technology to create sophisticated networks that can operate across multiple jurisdictions while remaining largely invisible to traditional law enforcement methods.

Protection Strategies for Financial Institutions and Consumers

Enhanced Banking Security Measures

The Telegram fraud ring case has prompted financial institutions to implement enhanced security measures to prevent insider threats and data breaches. Banks are now investing in more sophisticated monitoring systems that can detect unusual account activity and potential insider threats.

The case also highlights the importance of regular security audits and employee background checks, particularly for employees with access to sensitive customer data. Financial institutions must balance the need for efficient customer service with robust security measures to prevent data theft.

Consumer Protection and Education

The targeting of elderly victims by the Telegram fraud ring underscores the need for increased consumer education about cybersecurity and fraud prevention. Financial institutions and government agencies must work together to provide resources and education to help vulnerable populations protect themselves from sophisticated fraud schemes.

Consumers should be encouraged to monitor their accounts regularly, use strong passwords, enable two-factor authentication, and report suspicious activity immediately. The Telegram fraud ring case demonstrates that even sophisticated fraud operations can be detected and prevented through vigilant monitoring.

The Future of Cybercrime Prevention

International Cooperation and Regulation

The Telegram fraud ring case highlights the need for increased international cooperation in combating cybercrime. The use of encrypted messaging platforms and the international nature of criminal networks require coordinated responses from law enforcement agencies worldwide.

The case also demonstrates the need for updated regulations governing encrypted messaging platforms and their role in facilitating criminal activity. While privacy and encryption are important, they must be balanced against the need to prevent and investigate serious crimes.

Technology and Law Enforcement

The investigation of the Telegram fraud ring required law enforcement to develop new skills and capabilities for investigating cybercrime. The digital nature of modern crime requires investigators to understand technology, follow digital trails, and work with international partners to bring criminals to justice.

The success of this investigation demonstrates that law enforcement can adapt to new challenges and successfully dismantle sophisticated criminal networks, even when they operate across multiple jurisdictions and use advanced technology to conceal their activities.

Frequently Asked Questions (FAQ)

What was the Telegram fraud ring and how did it operate?

The Telegram fraud ring was a sophisticated $8.8 million banking fraud operation that used encrypted messaging platforms to facilitate the sale of stolen account data. The ring involved bank employees stealing customer data, selling it on Telegram channels, and using the information to drain elderly victims’ accounts through multiple fraudulent accounts.

What was the Telegram fraud ring and how did it operate?

The Telegram fraud ring was a sophisticated $8.8 million banking fraud operation that used encrypted messaging platforms to facilitate the sale of stolen account data. The ring involved bank employees stealing customer data, selling it on Telegram channels, and using the information to drain elderly victims’ accounts through multiple fraudulent accounts.

What role did Telegram play in the fraud ring?

Telegram served as the primary marketplace for the Telegram fraud ring, where stolen banking data was sold to criminals worldwide. The platform’s end-to-end encryption and secret chat features allowed criminals to communicate and conduct business without law enforcement detection, earning it the nickname “playground of criminals.”

How was the Telegram fraud ring discovered and dismantled?

The Telegram fraud ring was discovered when a banking detective noticed suspicious activity involving a $250,000 deposit. This led to an 18-month investigation involving multiple law enforcement agencies, 18 search warrants, and coordination across multiple states. The investigation resulted in RICO charges against the primary defendants and the dismantling of the criminal network.

Remember: The Telegram fraud ring case serves as a critical reminder that cybercrime continues to evolve and target vulnerable populations. Financial institutions, law enforcement, and consumers must remain vigilant and work together to prevent sophisticated fraud operations that exploit modern technology.