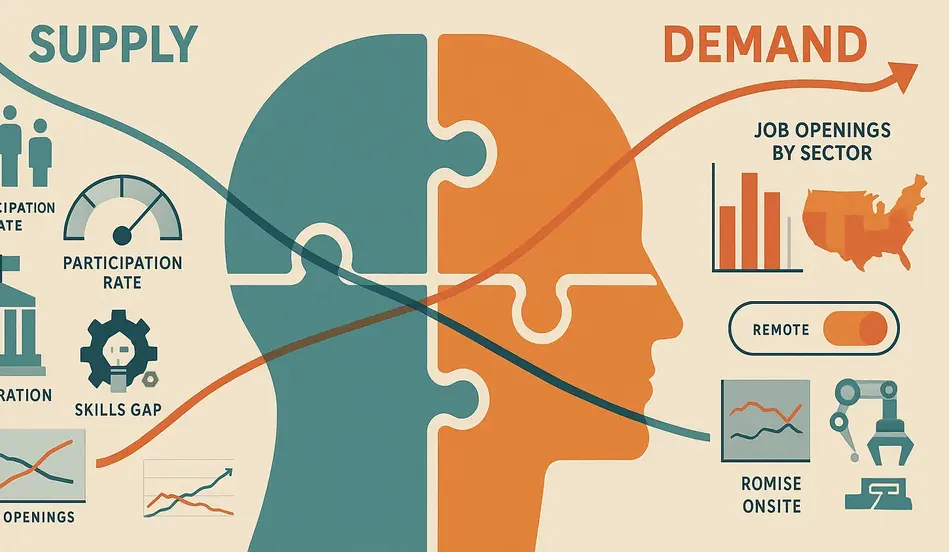

As the U.S. labor market enters the latter half of 2025, economists, policymakers, and employers find themselves grappling with a fundamental question: Which is exerting more influence on the slowing job market—weakened labor demand, or strained labor supply?

The Job Growth Slowdown: Key Signals Emerging

July 2025 delivered a disheartening employment report: U.S. nonfarm payrolls rose by just 73,000—a stark underperformance against expectations. Previous months also took a hit, with May and June’s figures revised down by a cumulative 258,000 jobs.

The unemployment rate ticked up to 4.2%, and labor force participation continued its slide, hitting 62.2%—a low not seen since 2021.

Meanwhile, continuing unemployment claims have surged to 1.97 million, the highest since November 2021. This suggests that job seekers are struggling to find work even as headline unemployment remains modest.

Side A: Labor Demand in Retreat

Many economists point to weakening labor demand as a primary culprit. Hiring has visibly slowed; companies cite economic uncertainty, elevated costs, and cautious forecasts in key sectors.

- Corporate caution: High borrowing costs, tighter credit conditions, and a weaker consumer spending outlook have led employers to scale back hiring plans.

- Sectoral drag: Industries like manufacturing, retail, and construction have reported hiring freezes or reduced recruitment budgets.

- Wage moderation: Average wage growth is easing toward 3.5%, suggesting less competition for talent compared to 2022–2023.

This hints at a broader cooling in business appetite for expansion—an effect that’s being amplified by geopolitical instability, shifting trade policies, and tariff pressures.

Side B: Labor Supply Constraints Persist

On the flip side, the labor supply picture isn’t much brighter. Several long-term, structural factors are limiting the availability of workers:

- Immigration policy changes

Stricter immigration rules have reduced the inflow of foreign workers, hitting industries like agriculture, hospitality, and healthcare particularly hard. - Demographic shifts

The aging Baby Boomer generation continues to exit the workforce faster than younger cohorts can replace them. Skilled trade professions are especially vulnerable. - Pandemic-era aftershocks

Some workers never returned post-COVID, citing health concerns, early retirement, or shifts to gig and freelance work. - Childcare and caregiving barriers

Limited access to affordable childcare is keeping some parents—especially women—out of the labor force.

A Narrowing Gap, But Still a Gap

In the early 2020s, job openings outnumbered unemployed workers by over 5 million—a historically large imbalance. Today, that gap has narrowed, but not vanished.

- Positive: Slightly better alignment between job seekers and openings.

- Negative: The narrowing is driven less by increased worker availability and more by reduced employer demand.

This means the U.S. has shifted from a red-hot labor market to one that is lukewarm but structurally constrained.

Bridging the Gap Between Job Openings and Talent

In a market where labor supply and demand are misaligned, WhatJobs helps you connect with the right candidates—faster.

Post a Job Now →A Two-Sided Slowdown

It’s not purely a matter of demand versus supply. In reality, both are weighing on job creation:

- Demand weakness is evident in slowing hiring rates, softening wage growth, and reduced job postings.

- Supply limitations persist in key skilled sectors, with shortages of nurses, electricians, and software engineers.

The result is a labor market that’s neither fully cooling nor fully recovering—a complex middle ground that makes policymaking tricky.

Sectoral and Regional Nuances

- Healthcare: Demand remains strong, but supply shortages are chronic due to years of underinvestment in training.

- Tech: Hiring is rebounding after 2023–2024 layoffs, but AI automation is reshaping job roles.

- Manufacturing: Faces both weaker demand (due to global trade shifts) and skill gaps in advanced production.

- Regional divide: Sunbelt states are seeing worker shortages due to rapid population and business growth; some Rust Belt regions face surplus labor and fewer openings.

Why It Matters: Economic and Policy Implications

1. Wage Pressures

Where labor supply remains tight, wages remain elevated. But in sectors with reduced demand, wage growth has slowed—creating a mixed inflation outlook.

2. Federal Reserve Policy

If demand weakness dominates, the Fed may cut interest rates to stimulate growth. If supply constraints dominate, inflation risks could delay such moves.

3. Immigration and Workforce Initiatives

Addressing supply issues may require targeted immigration reform, retraining programs, and incentives to rejoin the workforce.

4. Automation and AI Adoption

As companies face persistent worker shortages, AI and robotics adoption is accelerating—changing the skills employers seek and the types of jobs available.

Looking Ahead

- Short-term: The balance of supply and demand will guide whether the U.S. achieves a “soft landing” or slides into recession.

- Long-term: Without structural fixes—especially in immigration, education, and automation strategy—labor market frictions will persist.

- Wild card: Technological disruption could ease supply constraints but also reshape the very nature of work.

FAQ: Supply vs. Demand in the U.S. Labor Market

Q1: What is meant by “labor demand”?

Labor demand refers to the number of workers employers are willing and able to hire at a given wage. It rises when business conditions are strong and falls when costs, uncertainty, or weak sales discourage hiring.

Q2: What is “labor supply”?

Labor supply is the number of people willing and able to work. It depends on demographics, immigration, skills, and personal circumstances like childcare needs.

Q3: Why is the U.S. labor market slowing now?

A mix of weaker employer demand due to economic uncertainty and structural supply shortages from aging demographics, immigration limits, and pandemic aftershocks.

Q4: How does this affect wages?

When demand is high and supply is tight, wages rise quickly. Right now, wage growth is moderating because demand is cooling, even though supply is still constrained in some sectors.