Layoffs framed as “AI transformation,” chip and data‑center sprees, and eye‑popping partnerships have stoked fears that this boom rests on accounting alchemy and circular money flows. If it breaks, exposure won’t be contained to tech—it will run through index funds, pensions, and capex plans across the economy.

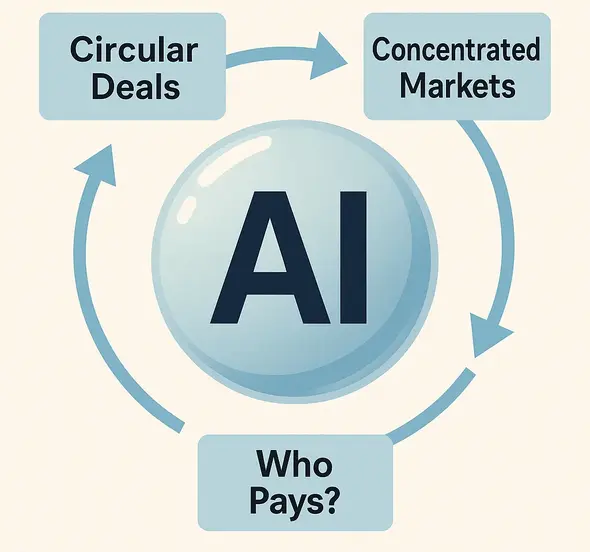

Circular Deals 101

The pattern critics highlight:

- A hyperscaler or chipmaker invests in an AI lab.

- The lab commits the proceeds to buy that investor’s cloud or chips.

- The investor books the lab’s spend as revenue, helping justify higher valuations and more capex.

Examples cited include multi‑billion commitments across cloud, chips, and custom silicon—sometimes announced in quick succession with multiple suppliers. The risk isn’t that partnership ecosystems exist (they always have). It’s when reciprocal flows dominate early revenues, obscuring true end‑user demand and ROI.

The Capex Math: Trillions In, Thin Revenues Out (For Now)

Analysts tally multi‑trillion dollar build‑outs for data centers, power, cooling, and chips through the decade. By contrast, near‑term AI software revenues remain modest. That gap can close if enterprise adoption scales—but MIT and others find most pilots don’t yet show measurable ROI. Early wins cluster in narrow, well‑scoped workflows.

The Market Concentration Problem

Seven companies—Apple, Microsoft, Nvidia, Amazon, Meta, Alphabet, Tesla—now represent ~one‑third of S&P 500 market cap. Many retirement accounts are effectively mega‑cap tech funds by stealth. If AI optimism fades or financing tightens, index investors take the hit, not just venture funds.

Why Leaders Still Spend Aggressively

- First‑mover advantage in platforms is durable. Missing the window can lock firms out of margins for years.

- Scarce inputs—chips, power, prime data center sites—reward early buyers.

- Some use cases already earn their keep (developer acceleration, search/ads, support deflection, fraud/risk).

The problem is breadth: can enough workflows reach provable ROI fast enough to validate the capex curve? That’s the hinge.

If The Music Slows: The Transmission Channels

1) Equity correction. Mega‑cap multiples compress; second‑tier AI names re‑rate harder.

2) Capex sequenced down. Data‑center and chip orders defer; unfinished sites strand costs; power projects slip.

3) Employment ripple. Generic roles shrink more; applied AI/data roles stay in demand but slower hiring.

4) Credit stress. Vendors dependent on AI build‑outs (and levered suppliers) feel tightening.

5) Policy backstops. Tax credits, procurement, and “strategic digital infrastructure” labels soften the landing.

If The Music Slows: The Transmission Channels

Every slowdown has a chain reaction. Equity compression hits first, capex cools next, and hiring momentum fades. Yet amid tightening cycles, demand for applied AI, data fluency, and infrastructure expertise persists — just more selectively. In volatility, capital and talent both rotate toward resilience.

Post Jobs & Hire Resilient Tech Talent →Is This 1999, 2008, Or Something New?

- Like 1999: lofty valuations, hype spillover, thin revenues in some segments.

- Like 2008: system‑wide exposure via indexes, corporate capex, and public incentives.

- Unlike both: the installed base (chips, fiber, power upgrades) has alternative uses; but chips depreciate fast, making time‑to‑payback critical.

How To Separate Hype From Health

Ask of any AI program:

- Cash yield: What cost is removed or revenue created per $1 invested within 12–24 months?

- Dependency: Are customers independent third parties, or reciprocal partners?

- Substitution: Is this workflow replacing compute, labor, or both—and is quality equal or better?

- Bottlenecks: Power, latency, data rights, safety evaluation—are these solved for scale?

- Governance: Is there measurement, audit, and rollback when models drift?

What Workers Can Do Now

- Become the ROI. Tie your work to measurable revenue, cost, or risk impacts using AI as a tool.

- Own the hard parts: data quality, evaluation, controls, and cross‑team execution.

- Build portable proof: before/after metrics, reproducible workflows, and references.

- Keep an offline plan: skills, savings, and networks that don’t depend on a single employer’s AI timeline.

What Investors Can Do Now

- Follow real demand. Favor firms with third‑party revenues and verifiable unit economics.

- Prefer picks‑and‑shovels with pricing power (power, cooling, materials) and software tied to concrete outcomes.

- Watch financing quality: vendor paper, prepayments, SPVs, and off‑balance‑sheet commitments.

- Diversify beyond mega‑cap tech concentration; know your equal‑weight and international exposure.

Key Takeaway

AI can be both transformative and over‑financed. Circular deals and capex races don’t negate long‑run value—but they raise near‑term risk if end‑customer ROI lags. Manage exposure, demand proof, and build skills that turn AI hype into durable productivity.

FAQs

Are “circular deals” illegal?

No per se. But if reciprocal flows mask true demand, investors should discount the quality of revenues until third‑party traction is clear.

Could governments bail out failed AI bets?

Likely via tax credits, public procurement, or grid investments—not direct rescues of labs. Infrastructure may be repurposed; chips depreciate quickly.

Is a crash inevitable?

Not necessarily. A slowdown and dispersion is more probable: leaders with clear ROI endure; speculative names deflate. Prepare for both paths.