A Surprising Shift in Monetary Policy Outlook

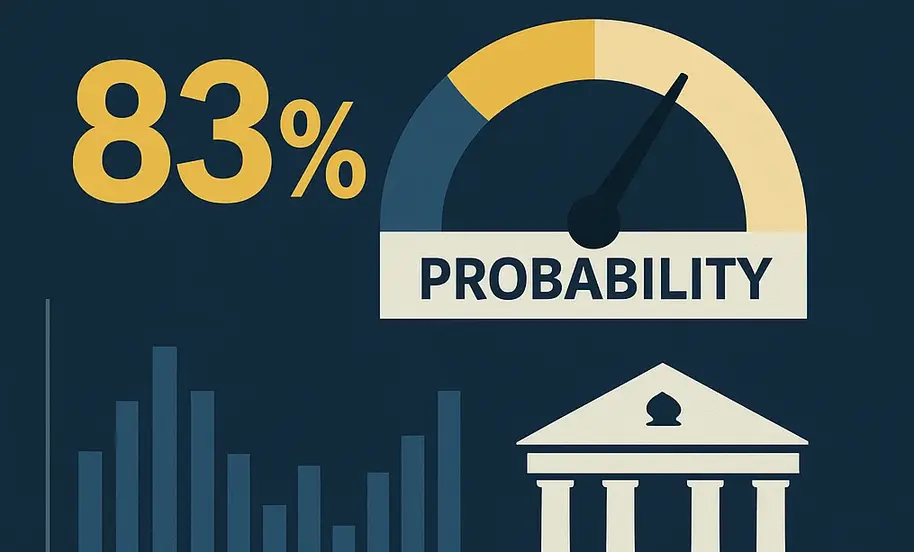

In recent weeks, the probability of a Federal Reserve rate cut in September 2025 has surged—shocking markets and forcing analysts to reassess everything from labor trends to inflationary threats. What once appeared to be a relatively stable outlook for Fed policy has become one of the most volatile and uncertain monetary periods in over a decade.

The dramatic surge—from roughly 30% to over 80%—followed significant employment data revisions from the Bureau of Labor Statistics (BLS). The downgrading of job growth estimates sparked investor concerns about a slowing economy and prompted a rapid repricing of expectations for monetary policy easing.

But beneath the headlines lies a deeper question: Is the Fed reacting to real signs of economic distress, or is this just a statistical misfire?

Job Data Revisions: Recalibrating Market Expectations

The catalyst for the market’s reaction was the BLS’s unexpected downward revision of May and June’s employment numbers. Initial readings had painted a picture of resilience; the updates revealed something more fragile.

This recalibration led investors to anticipate a shift in monetary direction. However, economists caution that revisions don’t necessarily equate to economic weakness. Measurement challenges in a post-pandemic labor market, particularly around part-time and gig work, can distort the real employment picture.

What’s clear is that policy makers are under pressure to respond swiftly—potentially before the true nature of the labor market becomes fully visible.

Supply Constraints or Demand Weakness?

At the core of the Fed’s dilemma lies an ongoing debate: Are we facing a shortage of labor due to reduced immigration and demographic shifts, or is there a deeper demand-side issue?

Some analysts argue that slower job growth may not reflect declining demand but rather a shrinking labor force. If that’s the case, aggressive policy easing could worsen inflation without solving labor shortages.

Others contend the slowdown is more structural, suggesting that businesses are pulling back on hiring amid cost pressures and global uncertainty. Either way, policymakers must tread carefully.

The Inflation Crossroads

Layered atop labor questions is the issue of persistent inflation. While price pressures have eased from 2022 peaks, inflation remains above the Fed’s 2% target.

A premature rate cut, especially in the face of sticky prices and new tariff-related inflation risks, could backfire. Supply chain disruptions and energy shocks continue to stoke fears of renewed price surges.

The Fed now faces the impossible task: stimulate growth without reigniting inflation. It’s a classic policy bind, and market watchers are split on how the central bank will proceed.

Leadership Changes Shake Up the Fed’s Direction

Complicating the outlook are recent changes in Fed leadership, including the surprise resignation of Governor Adriana Cougler. Her departure, coupled with growing dissent within the Federal Open Market Committee (FOMC), has altered the balance of power.

Two members previously viewed as hawkish have shifted tone, citing data-driven concerns about slowing growth. Meanwhile, new nominees to the Board may further tilt consensus toward dovishness.

Leadership turnover doesn’t just shape internal debates—it also affects how clearly the Fed communicates its policy goals to the public and markets.

Market Volatility and Investment Strategy

Investors across the board are reacting to the policy shift. Bond yields have declined sharply, as falling rate expectations increase the value of fixed-income securities.

Sectors like real estate and tech, which benefit from lower borrowing costs, have rallied. Meanwhile, financials and energy have lagged amid expectations of narrower margins and subdued demand.

Currency markets are also in flux, with the U.S. dollar weakening against major peers. A potential Fed pivot adds pressure on other central banks, many of which are already battling inflation at home.

Looking to Hire Fast?

Hiring managers can now post jobs for free on WhatJobs

and connect with millions of jobseekers.

👉 Post a Job Now →

The Fragile Role of Economic Data in Fed Decisions

One of the more concerning aspects of the recent policy pivot is the Fed’s reliance on preliminary employment data—which is often subject to revision. This leaves monetary policy open to whiplash effects driven by flawed short-term data.

Experts now question whether the Fed needs to broaden its toolkit. Some suggest incorporating private-sector data sources, sentiment indexes, and longer-term labor participation trends to supplement official metrics.

Improving communication and transparency will be key to managing market expectations in the months ahead.

Global Implications of U.S. Policy

As the world’s most influential central bank, the Fed’s decisions carry global repercussions.

Lower rates in the U.S. lead to capital outflows to emerging markets, affect exchange rates, and even force foreign central banks to mirror policy adjustments to avoid imbalances.

In 2025, these effects are magnified by ongoing global tensions, trade fragmentation, and fragile supply chains. A potential Fed rate cut isn’t just a domestic event—it’s a macro-level turning point.

The Business View: Caution and Opportunity

For American businesses, the looming policy decision means one thing: uncertainty.

Interest-sensitive sectors such as housing and autos may benefit from cheaper financing. Others may worry about the broader macro environment—are we easing into a soft landing or bracing for recession?

Some firms are already refinancing existing debt, anticipating lower rates ahead. But strategic planning remains difficult in this unpredictable environment.

What Comes Next for the Fed?

With the September meeting fast approaching, all eyes are on Chair Jerome Powell and his team. Will the Fed embrace the market’s expectations, or will it attempt to recalibrate investor sentiment?

Either way, the next move will have long-lasting consequences. The institution must carefully weigh its dual mandate—price stability and full employment—while navigating an evolving economic landscape.

FAQ: Federal Reserve Rate Cut September 2025

What triggered the surge in expectations for a Federal Reserve rate cut in September 2025?

Recent downward revisions to employment data led investors to anticipate a slowdown in the U.S. economy, prompting expectations for monetary easing by the Federal Reserve.

How might a rate cut affect the stock and bond markets?

A rate cut typically lowers bond yields and supports interest-sensitive equity sectors like housing and tech. However, it can also signal economic weakness, which may dampen broader investor sentiment.

What risks are associated with a premature policy move?

Cutting rates while inflation remains elevated could reignite price pressures and weaken the Fed’s credibility, especially if economic weakness proves to be overstated or temporary.

How should businesses prepare for the upcoming Fed decision?

Companies should monitor borrowing costs, reassess financing strategies, and prepare contingency plans for both lower and higher-rate scenarios depending on industry exposure.