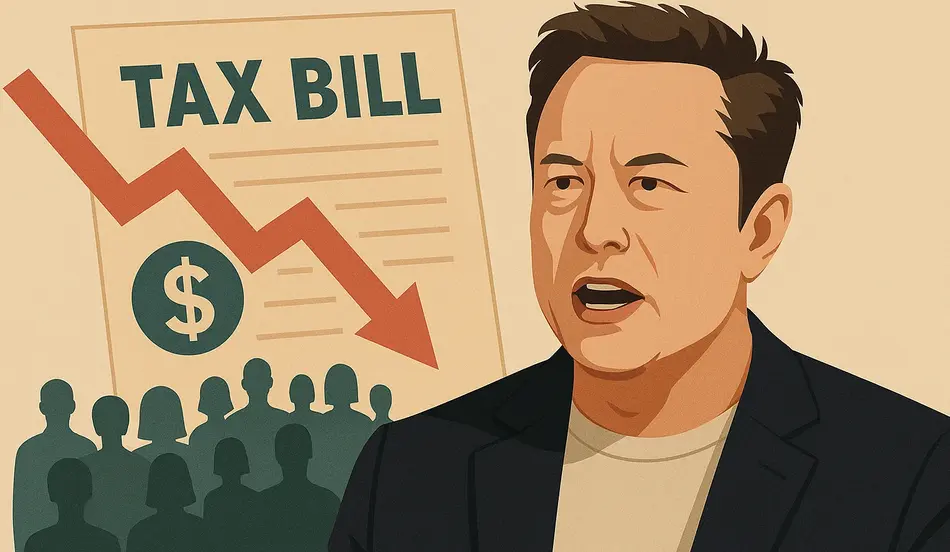

Recent developments have placed tech mogul Elon Musk back in the spotlight as he delivers a scathing critique of President Donald Trump’s latest tax and spending legislation. The Tesla and SpaceX CEO has issued stark warnings about the potential economic fallout, claiming the bill could devastate America’s job market and compromise the nation’s technological leadership on the global stage.

This comprehensive analysis examines Musk’s Elon Musk tax bill criticism, the specific concerns he’s raised, and the broader implications for America’s economic future and innovation landscape.

The Core of Elon Musk’s Tax Bill Criticism

Musk’s Alarming Assessment

Taking to his social media platform X, Musk didn’t mince words when describing the Senate’s draft tax and spending bill as “utterly insane and destructive.” His Elon Musk tax bill criticism centered on two primary concerns:

- The potential destruction of “millions of jobs in America”

- The risk of causing “immense strategic harm” to the nation’s economic future

The tech entrepreneur’s comments reflect growing tension between traditional industry advocates and those pushing for investment in emerging technologies that could define America’s economic competitiveness for decades to come.

Specific Policy Objections

Musk’s critique specifically targets how the legislation prioritizes what he terms “industries of the past” while neglecting future-focused sectors. His Elon Musk tax bill criticism highlights several problematic areas:

- Insufficient support for artificial intelligence development

- Reduced incentives for clean energy innovation

- Limited investment in robotics and automation

- Rollbacks on electric vehicle tax credits that directly impact companies like Tesla

Hiring?

Looking for Top Tech and Innovation Talent?

Post jobs for free with WhatJobs and connect with qualified professionals ready to drive your organization’s future growth.

The Controversial $800 Billion Package

Key Provisions Under Scrutiny

The Senate version of the bill, backed by Trump and prominent Republican lawmakers, proposes approximately $800 billion in combined tax cuts and federal spending. Among the most contentious elements in Musk’s Elon Musk tax bill criticism:

- $150 billion allocated for fossil fuel infrastructure

- Significant reductions in electric vehicle tax credits

- Decreased funding for AI innovation grants

- Cuts to clean technology research initiatives

These provisions represent a clear policy shift that many tech leaders, including Musk, view as potentially undermining America’s competitive advantage in rapidly evolving global markets.

Political Context and Tensions

The Elon Musk tax bill criticism marks a renewed point of tension between Trump and one of technology’s most influential figures. After a period of apparent reconciliation following previous public disagreements, this latest development suggests the relationship remains complicated:

- Trump’s populist base has strongly supported traditional manufacturing and fossil energy sectors

- Tech industry leaders warn that reducing future-focused investments could hamper American innovation

- The bill reflects broader ideological divisions about America’s economic priorities

According to recent analysis from the Center for Strategic and International Studies, policy decisions that prioritize established industries over emerging technologies often fail to account for long-term economic transformation patterns.

Global Competition Concerns

China’s Aggressive Technology Investments

A central element of Musk’s Elon Musk tax bill criticism involves the global competitive landscape. While the U.S. debates reducing support for emerging technologies, international rivals are making substantial investments:

- China invested approximately $280 billion in electric vehicle and battery technology in 2024 alone

- Chinese AI research funding has increased by 22% annually over the past five years, according to the Stanford AI Index Report

- Government-backed initiatives have positioned China as a leader in several emerging technology sectors

European Union’s Strategic Approach

Similarly, the European Union has recognized the strategic importance of future technologies:

- The EU passed a $114.83 billion AI innovation pact in 2024

- European clean energy investments reached record levels, with over €45 billion committed to renewable infrastructure

- Coordinated policy frameworks have been established to support technology development across member states

Economic Impact Projections

Job Market Implications

Musk’s warning about “millions of jobs” at risk reflects genuine concerns about economic transformation:

- Traditional vs. Emerging Sectors: While fossil fuel industries employ significant numbers today, growth projections favor technology and clean energy sectors

- Skill Transition Challenges: Workers may face difficulties adapting to new industry requirements without adequate support

- Regional Economic Disparities: Areas heavily dependent on traditional industries could experience disproportionate negative impacts

- Innovation Ecosystem Effects: Reduced R&D funding could limit startup formation and growth in high-potential sectors

Long-Term Competitive Position

Economic analysts from institutions like the Brookings Institution have highlighted how today’s investment decisions shape tomorrow’s economic landscape:

- Nations leading in AI development could capture up to 70% of the estimated $15.7 trillion in global economic value AI will create by 2030

- Clean energy leadership positions countries to benefit from an industry projected to exceed $2.15 trillion by 2028

- Early advantages in emerging technologies often translate to sustained economic benefits through network effects and ecosystem development

Search for technology and innovation jobs on WhatJobs

Strategic Recommendations for Policymakers

Balancing Traditional and Future Industries

Effective economic policy must acknowledge both immediate needs and future opportunities:

- Create transition pathways for workers in traditional industries

- Maintain strategic investments in high-growth technology sectors

- Develop place-based policies that address regional economic disparities

- Establish public-private partnerships to accelerate innovation in critical areas

Learning from Global Best Practices

Several nations have successfully navigated similar economic transitions:

- South Korea’s strategic pivot to technology leadership

- Germany’s balanced approach to manufacturing modernization

- Singapore’s forward-looking economic development strategy

Need Career Advice?

Concerned About Your Future in a Changing Economy?

Get expert guidance on skill development, career transitions, and emerging opportunities in high-growth sectors.

FAQ: Elon Musk Tax Bill Criticism

What specific concerns did Elon Musk raise in his tax bill criticism?

In his Elon Musk tax bill criticism, the tech CEO warned that the Senate’s draft tax and spending bill could “destroy millions of jobs in America” and cause “immense strategic harm.” He specifically criticized how the legislation prioritizes traditional industries like fossil fuels while reducing support for future-focused sectors such as AI, clean energy, and robotics that are critical for America’s long-term economic competitiveness.

How does Elon Musk’s tax bill criticism relate to global competition?

Elon Musk’s tax bill criticism highlights how reducing investments in emerging technologies could disadvantage the United States against global competitors. While the U.S. considers cutting funding for innovation, China has invested $280 billion in EV and battery technology in 2024, and the EU has passed a $114.83 billion AI innovation pact. This funding disparity could potentially shift technological leadership away from America.

What industries would be most affected according to Elon Musk’s tax bill criticism?

According to Elon Musk’s tax bill criticism, the bill would particularly impact forward-looking industries including artificial intelligence development, clean energy innovation, electric vehicle manufacturing, and robotics. These sectors represent high-growth potential areas that Musk believes are essential for America’s future economic prosperity and global competitiveness.

Why has Elon Musk’s tax bill criticism created tension with the Trump administration?

Elon Musk’s tax bill criticism has reignited tensions with the Trump administration after a period of apparent reconciliation between the two. The criticism highlights fundamental differences in economic vision, with Trump’s base supporting traditional manufacturing and fossil energy industries, while Musk advocates for prioritizing emerging technologies. The $800 billion bill includes $150 billion for fossil fuel infrastructure and rolls back EV tax credits that directly affect Tesla, Musk’s company.